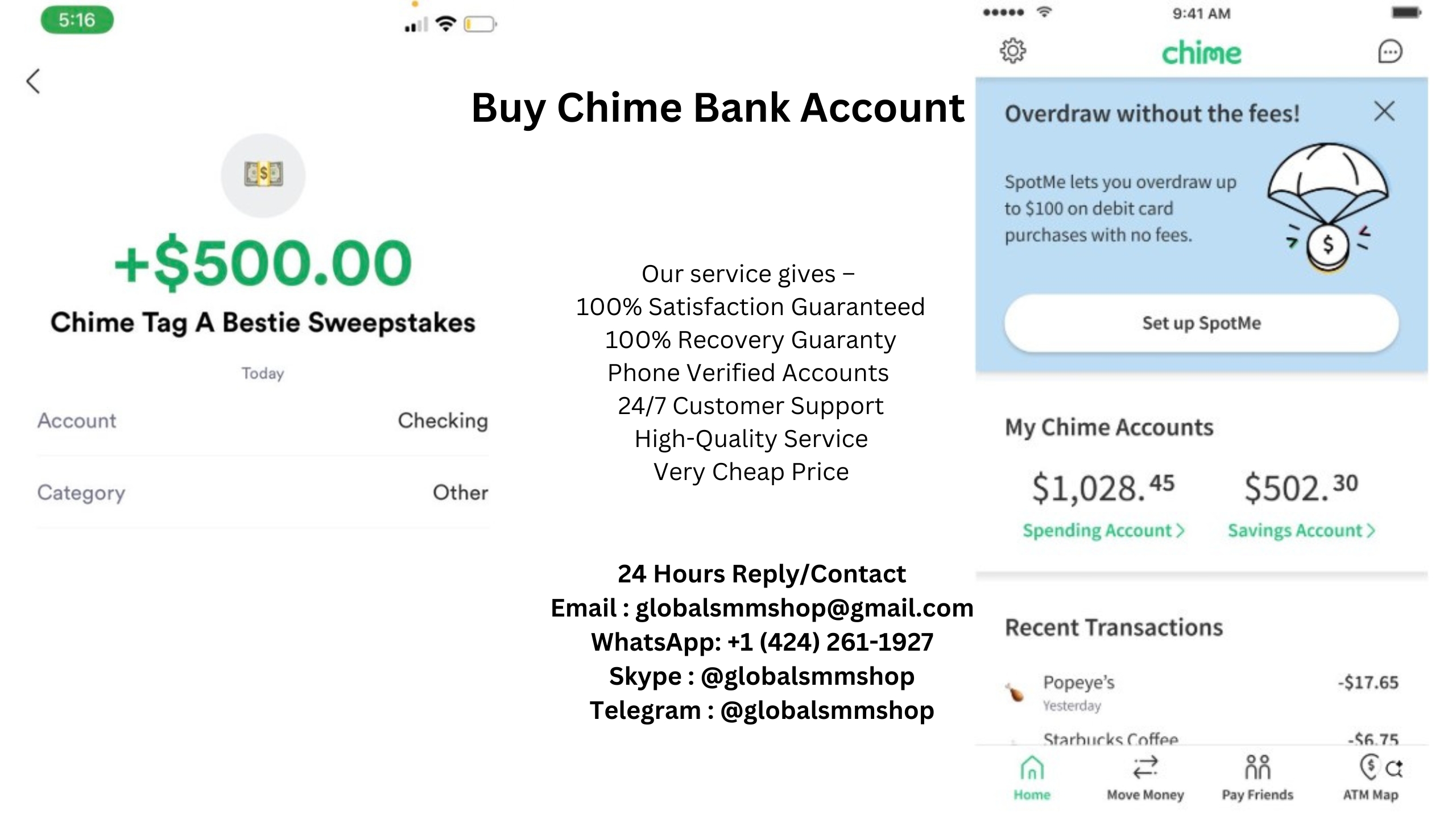

Buy Chime Bank Account

Opening a Chime Bank account can be a smart move. It offers many benefits.

Chime is a popular online bank with no hidden fees. It provides easy access to your money. In today’s digital age, managing finances online has become the norm. Chime Bank stands out for its user-friendly services and transparent policies. Imagine not having to worry about monthly fees or minimum balances.

Chime makes banking simple and stress-free. With direct deposit, you get your paycheck up to two days early. Plus, its app offers real-time alerts and easy money transfers. If you’re looking for a modern banking solution, Chime might be the right choice. Read on to discover why a Chime Bank account could be perfect for you.

Introduction To Chime Bank

Chime Bank is a modern financial technology company. It offers a range of banking services to its users. Many people prefer Chime for its user-friendly approach.

What Is Chime Bank?

Chime Bank is a financial service provider. It operates online without physical branches. It aims to make banking easier and more accessible.

Chime partners with The Bancorp Bank and Stride Bank. These partners ensure your deposits are FDIC insured.

Key Features

Chime Bank offers several attractive features. Here are some key highlights:

- No Monthly Fees: Enjoy banking without hidden charges.

- Early Direct Deposit: Get paid up to two days earlier.

- Automatic Savings: Save money with every purchase.

- Real-Time Alerts: Receive instant notifications for transactions.

- Overdraft Protection: Avoid fees with SpotMe feature.

Below is a table summarizing Chime Bank’s key features:

| Feature | Description |

|---|---|

| No Monthly Fees | Bank without worrying about monthly charges. |

| Early Direct Deposit | Receive your paycheck earlier. |

| Automatic Savings | Save money automatically with each transaction. |

| Real-Time Alerts | Get instant alerts for your transactions. |

| Overdraft Protection | Use the SpotMe feature to avoid overdraft fees. |

Benefits Of Chime Bank Account

Choosing the right bank account is important. With a Chime Bank Account, you get a lot of benefits. This account is designed to make banking easy and stress-free. Below are some key benefits of having a Chime Bank Account.

No Hidden Fees

Traditional banks often have hidden fees. These fees can add up quickly. With a Chime Bank Account, there are no hidden fees. You won’t see monthly fees, minimum balance fees, or overdraft fees. This means you can save more of your hard-earned money.

Here’s a quick comparison:

| Fee Type | Traditional Bank | Chime Bank |

|---|---|---|

| Monthly Fee | $10 – $15 | $0 |

| Overdraft Fee | $35 | $0 |

| Minimum Balance Fee | $5 – $10 | $0 |

Automatic Savings

Saving money can be hard. Chime makes it easier with automatic savings features. You can set up automatic transfers to your savings account. This way, you save money without even thinking about it.

Chime also rounds up your purchases to the nearest dollar. The extra change goes directly into your savings. It’s a simple way to save without effort. Here’s how it works:

- You make a purchase for $2.50.

- Chime rounds it up to $3.00.

- The extra $0.50 goes into your savings account.

These small amounts add up over time. It helps you grow your savings effortlessly.

How To Open A Chime Bank Account

Opening a Chime Bank account is simple and straightforward. This guide will help you through the process. Here, you will find the steps and the required documents. Let’s get started on how to open a Chime Bank account.

Step-by-step Process

To open a Chime Bank account, follow these steps:

1. Visit the Chime website or download the app.

2. Click on the “Get Started” button.

3. Enter your email address and create a password.

4. Fill in your personal details like your name and address.

5. Review and accept the terms and conditions.

6. Submit your application.

Once your application is submitted, Chime will review it. You will get an email with further instructions.

Required Documents

To open a Chime Bank account, you need some documents. Make sure you have:

1. A valid government-issued ID, like a driver’s license or passport.

2. Your Social Security number.

3. Proof of address, such as a utility bill.

These documents will help verify your identity. Have them ready to speed up the process.

Opening a Chime Bank account is easy with the right documents and steps. Follow this guide, and you’ll be set up in no time.

Chime Bank Mobile App

The Chime Bank Mobile App has transformed how people manage their finances. It’s designed for modern users who need access to their accounts anytime, anywhere. This app offers convenience and ease of use, making it a popular choice among users.

User-friendly Interface

The Chime Bank Mobile App boasts a user-friendly interface. Navigating the app is straightforward. Clear menus and intuitive design guide users effortlessly. Even those new to mobile banking will find it easy to use.

Key Functionalities

The app offers several key functionalities that enhance the banking experience. Users can check their account balance with a simple tap. Transferring funds between accounts is quick and easy. The app also allows users to deposit checks remotely. This saves time and avoids trips to the bank.

Another great feature is the ability to send money to friends and family. Users can do this without any fees. Real-time alerts keep users informed of all account activities. This helps in monitoring transactions and avoiding fraud.

Users can also set up direct deposits within the app. This ensures timely payments and easy access to funds. The Chime Bank Mobile App supports budget management tools. These help users track their spending and save money.

Security Features

Security is a critical concern for anyone looking to open a bank account. Chime Bank provides robust security features to ensure your money and personal information remain safe. This post will explore some key security features of a Chime Bank account.

Account Protection

Chime Bank uses advanced encryption to protect your account information. This means your data is scrambled and unreadable to unauthorized users. Only you and Chime can access your details.

Two-factor authentication (2FA) adds another layer of security. You need to verify your identity with a second device. This makes it harder for hackers to gain access.

Fraud Detection

Chime Bank employs real-time fraud monitoring. The system scans for unusual activity on your account. If it detects anything suspicious, it will alert you immediately.

You can also set transaction alerts. These will notify you of every purchase or withdrawal. This helps you keep track of your account and spot fraud quickly.

Customer Support

Having reliable customer support is essential for any financial service. When you buy a Chime Bank Account, you get access to a team dedicated to helping you. This section will cover how you can contact them and what to expect.

Contact Methods

Chime offers several ways to reach their customer support team:

- Phone: Call their support line for direct assistance.

- Email: Send an email and get a detailed response.

- Live Chat: Use the live chat feature for immediate help.

- Social Media: Reach out via their official social media channels.

Response Time

Understanding how quickly you can get help is crucial:

- Phone: Immediate connection in most cases.

- Email: Typically responds within 24 hours.

- Live Chat: Average wait time is under 5 minutes.

- Social Media: Responses within a few hours.

Chime’s customer support is designed to be fast and efficient. Whether you need help setting up your account or solving a problem, their team is ready to assist you.

Comparing Chime With Traditional Banks

In today’s banking world, choosing the right bank is crucial. Many people are moving from traditional banks to modern options like Chime. To help you make an informed decision, let’s compare Chime with traditional banks.

Fee Comparison

Traditional banks often charge various fees. These can include monthly maintenance fees, overdraft fees, and ATM fees. These fees can add up over time. Chime, on the other hand, prides itself on being fee-friendly. There are no monthly fees or overdraft fees. Plus, Chime offers access to thousands of fee-free ATMs. This can save you a lot of money.

Service Comparison

Traditional banks provide a range of services. They offer physical branches, personal bankers, and a variety of account types. This can be useful for some customers. Chime is different. It operates online and through a mobile app. This makes it very convenient. You can access your account anytime, anywhere. Chime also offers early direct deposit and helpful money management tools. These services can help you manage your money better.

Customer Reviews And Testimonials

Customer reviews and testimonials provide valuable insights into the user experience with a Chime Bank account. They highlight the strengths and potential areas for improvement. Here’s an overview of what customers are saying.

Positive Feedback

Many users appreciate the no-fee structure of Chime Bank. They find the lack of hidden charges refreshing. Additionally, users enjoy the early direct deposit feature. It allows them to receive their paychecks up to two days early.

- User-friendly mobile app: The app is intuitive and easy to navigate.

- Real-time transaction alerts: Customers like getting instant notifications.

- Automatic savings: Many find the savings tools helpful.

Another common praise is the customer service. Many users report quick and helpful support. They feel their issues are resolved efficiently.

Areas For Improvement

While many reviews are positive, some users suggest improvements. For instance, some customers experience delays with mobile check deposits. They would like quicker processing times.

Another point of feedback is the lack of physical branches. Some users miss the option of visiting a local branch. They feel it would be useful for certain transactions.

| Area | Feedback |

|---|---|

| Mobile Check Deposits | Some delays in processing. |

| Physical Branches | Lack of in-person support. |

Some users also mention ATM fees for out-of-network withdrawals. They suggest more fee-free ATM options would be beneficial.

Overall, while there are areas for improvement, many customers are satisfied with their Chime Bank account.

Frequently Asked Questions

What Is A Chime Bank Account?

A Chime bank account is a mobile-first bank account with no monthly fees. It offers features like early direct deposit, automatic savings, and a user-friendly app.

How Do I Open A Chime Account?

Opening a Chime account is simple and quick. Download the Chime app, provide your personal information, and verify your identity.

Are There Fees For Chime Bank Accounts?

Chime bank accounts have no monthly fees, overdraft fees, or minimum balance requirements. Some fees may apply for out-of-network ATM usage.

Is Chime Bank Account Safe?

Yes, Chime bank accounts are safe. They are FDIC insured up to $250,000 through The Bancorp Bank or Stride Bank, N. A.

Conclusion

Choosing Chime Bank can simplify your banking experience. It offers many benefits. No hidden fees, easy access, and helpful customer support. It’s perfect for those seeking convenience and transparency. The mobile app is user-friendly, making money management a breeze. Why not give Chime Bank a try?

It could be the banking solution you need. Make the switch today and enjoy the advantages of modern banking.

Reviews

There are no reviews yet.